We enable strategies with outstanding ETF quality! Based on our rating and clear rules!

The recipe is simple to implement - the best quality ETFs as a mixed portfolio, provided you have a database at hand that rates all ETFs according to their quality. This is how we believe you can build a true Xenixfolio strategy. Too often, however, the focus is only on the "best" performance of ETFs achieved in the past and the quality aspect is almost completely ignored. Such an approach is not systematic and thus cannot bring recurring investment success.

We have been using balanced ETF Portfolios that focus on global diversification and quality ETFs as part of advisory mandates since 2009. We then also like to talk about Xenixfolio Strategies, which combine good ratings and clear portfolio rules.

Our global ETF Portfolio Strategies leverage the results of capital market research and the qualitative XENIX STARS ETF rating. In principle, this combination delivers predictable and stable investment results, especially if one focuses on distributing ETFs with regular returns.

An ETF Portfolio full of "Award Winners"

We have been calculating this Xenixfolio strategy since March 2023. This ETF portfolio is based on six winning ETFs of the XENIX ETF AWARDS Germany 2023, which we awarded in a ceremony on March 2, 2023 together with the gettex stock exchange in Munich.

This "Winners" ETF Portfolio follows a balanced 60-40 strategy: 60% equities and 40% bonds. It consists of six winning ETFs from four different providers, including four equity and two bond ETFs. This strategic asset allocation deliberately excludes, for example, U.S., Japanese and British equities and focuses on German equities, euro dividend stocks and emerging market equities. In this way, investors can use the XENIX Awards Winners ETF Portfolio (DE23) as a supplement to a portfolio in which, for example, ETFs on the MSCI World, MSCI AC World or the FTSE All-World dominate.

Test your ETF Portfolio or your managed solutions with ETFs now without obligation in comparison to our XENIX Awards Winners ETF Portfolio (DE23)!

Excellence ETF strategy beats average quality

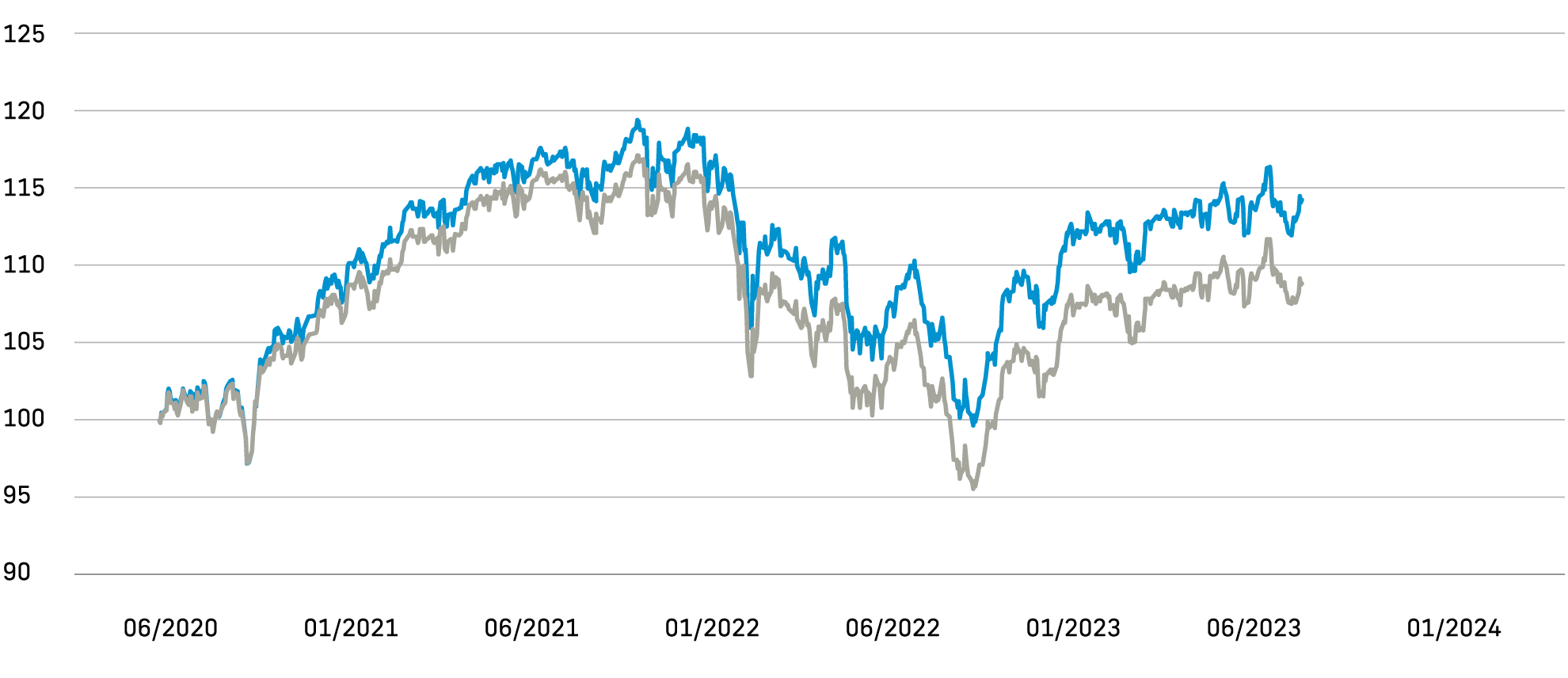

The chart shows it, excellent quality ETFs outperform average quality benchmark ETFs. Remarkably, however, not only is the performance of the winning portfolio better, but its price trend is also smoother on average, i.e. less volatile. Specifically, the one-year volatility of this ETF Portfolio (with six ETFs) in March 2023 was around 11.9% per year while the six comparable ETFs fluctuated more at around 12.3% per year.

In terms of the "maximum drawdown" risk measure, which captures the maximum interim decline in a portfolio's share price in percentage terms (calculated here on the basis of the providers' ETF share prices calculated on each trading day at the close of trading), it can be seen that our Excellence ETF portfolio suffered an interim price decline of around 16.5% during the Corona Crash in March 2020, while the comparison portfolio with average-quality ETFs lost around 18.4% in value, i.e. almost 2 percentage points more temporarily.

As of August 31, 2023, the German Winners XENIX ETF Portfolio is about 5.0 percentage points ahead of the average portfolio in just over three years (since the start of calculation). Specifically, this means that the German Winners XENIX ETF Portfolio gained around +14.2%, while the average ETF portfolio only gained around +8.8%.

Legend: XENIX Awards Winners ETF Portfolio (DE23) = blue line - performance chart (with back-calculation until Aug. 2020) and since calculation start (March 2023) compared to ETFs with medium quality.

A Xenixfolio Strategy with 14,000 securities

The XENIX Awards Winners ETF Portfolio (DE23) is broadly diversified with approximately 14,000 securities, of which more than 10,500 securities are fixed income bonds that regularly provide interest income and nearly 3,500 securities are equities that regularly generate dividend income.

The XENIX Awards Winners ETF Portfolio (DE23) is a balanced portfolio and broadly diversified with approximately 14,000 securities, of which more than 10,500 securities are fixed income bonds that regularly provide interest income and nearly 3,500 securities are equities that regularly generate dividend income.

Value-added strategy

The XENIX Awards Winners ETF Portfolio (DE23) is an example of a Xenixfolio Strategy that focuses on excellent quality ETFs from four different providers, which follow predominantly a broad market approach.

You still have questions about the quality-focused and rating-based ETF Portfolio Strategies of XENIX? You can find answers here.